Welcome to MikeRoberto.com!

Popular counterculture musings on sports, heavy music, entrepreneurship, and the American Dream.

New Decade, Bigger Mission. My Plan Heading into 2020.

The trajectory of the sports nutrition supplement industry, the industry I am a part of, has been a completely unexpected yet incredibly satisfying thing to see. We’re now at a point where there are SO many brands who are doing it “right” that it’s made our lives easy. In this case, I consider “right” as full efficacious dosing, manufacturing disclosure, providing lab tests or having drug-tested supplements, etc… and they taste good these days too. … Read the rest →

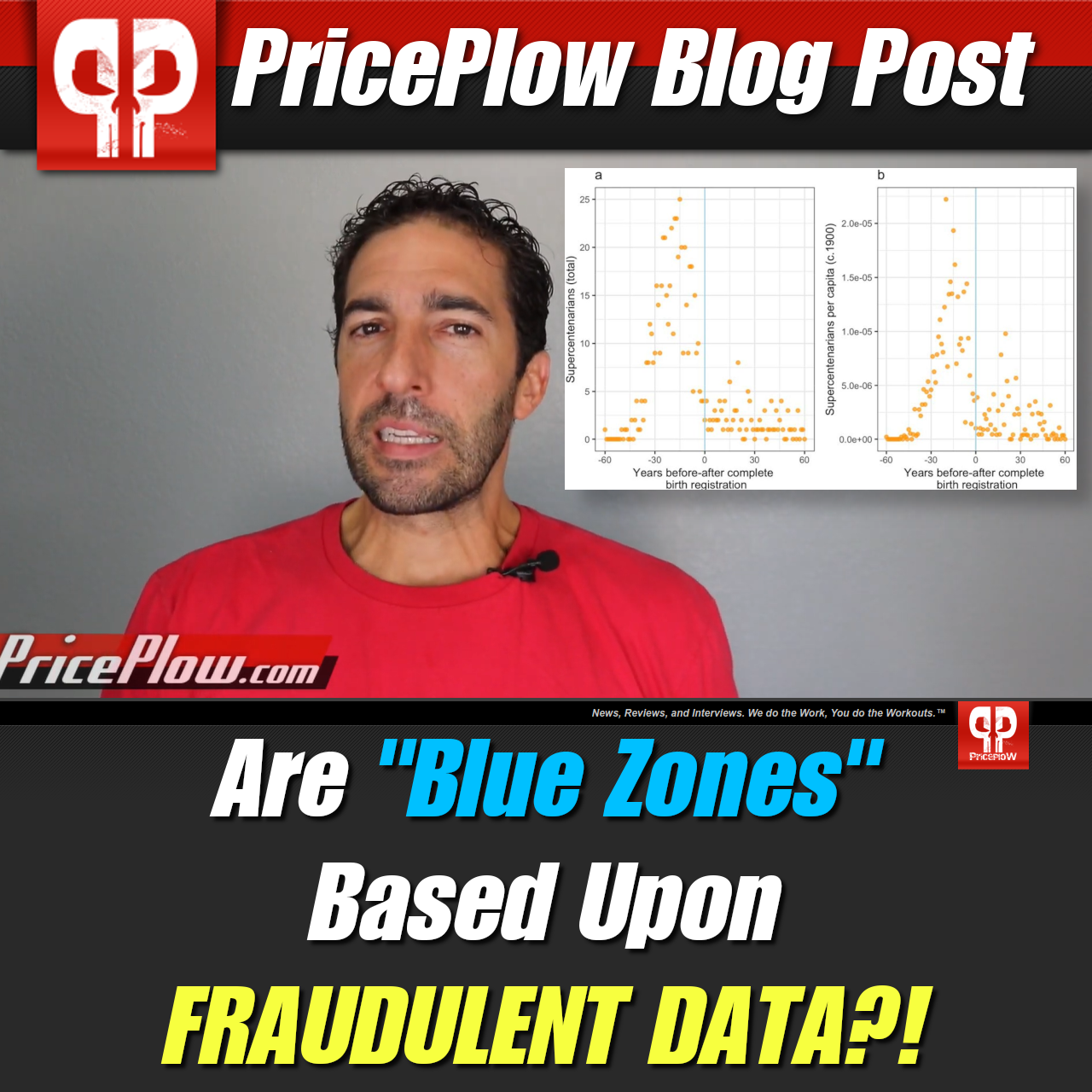

Are Blue Zones Based Upon FRAUD? New Research May Suggest…

Imagine this. You were born in 1925 in a rural area in Italy and have no birth certificate. It’s now 1965, so you’re 40 years old. You know that pensions are given to those who are 60 or older. You’re poor, uneducated, and have just about nothing to lose.

Knowing that you don’t really exist on paper, you submit pension paperwork stating you were born in 1905. What’s the worst that can happen?

Voila, … Read the rest →

Do Athletes Need Carbs? Doctor Tro Kalayjian Analyzes the Data

There’s no question that a well-formulated ketogenic diet has incredible weight loss and fat-burning benefits, especially from those suffering from hyperinsulinemia or carbohydrate control issues, especially when paired with intermittent fasting.

The reasons are frequently debated — whether it’s simply a restriction of calories, a leveraging of additional protein, or if there’s something more going on — but regardless, for many dieters who’ve been struck by our poisonous processed food supply, restricting carbohydrates to a … Read the rest →

My Keto Diet Review: Thoughts After Three Years

After three “runs” on the ketogenic diet, I’d like to lay out my thoughts, and where I see the future heading. Or at least, where I see my future with it heading.

Follow along on videoThis article was also turned into a video. It differs in details, but is the same general message, in case you’d rather watch than read:

First, we need some background, including my definition of the diet and a discussion … Read the rest →

High Protein Diets Do NOT Cause Kidney Issues: Meta-Analysis

“The great enemy of truth is very often not the lie – deliberate, contrived, and dishonest – but the myth – persistent, persuasive, and unrealistic. Too often we hold fast to the cliches of our forebears. We subject all facts to a prefabricated set of interpretations. We enjoy the comfort of opinion without the discomfort of thought.”

— John F. Kennedy[1]

Sometimes, no matter how much data you throw at a lie, it just won’t … Read the rest →

Soybean Oil WRECKS the Gut Microbiome.. But They Won’t Tell You That

For years, the most well-researched members of the diet community have warned of the dangers of omega-6 polyunsaturated fatty acids (PUFAs) such as soybean oil, given their high propensity for inflammation, obesity, and disease. A six month, randomized controlled diet study run in China has given new evidence for those warnings, as a diet high in soybean oil significantly damaged the gut microbiome in participants.[1]

The soybean study scandalBut the real story here … Read the rest →